All Categories

Featured

Table of Contents

If you're a person with a low tolerance for market fluctuations, this insight could be important - IUL growth strategy. Among the vital elements of any kind of insurance coverage is its expense. IUL policies frequently come with numerous fees and costs that can impact their total worth. A monetary advisor can break down these costs and help you consider them versus other low-cost financial investment options.

Pay specific interest to the policy's functions which will be crucial depending upon how you want to use the policy. Talk to an independent life insurance policy agent who can help you choose the best indexed universal life policy for your demands.

Testimonial the policy thoroughly. Now that we have actually covered the advantages of IUL, it's vital to recognize how it compares to various other life insurance coverage policies readily available in the market.

By understanding the resemblances and differences in between these policies, you can make a much more educated decision regarding which sort of life insurance is ideal suited for your needs and economic objectives. We'll start by comparing index universal life with term life insurance policy, which is frequently thought about one of the most uncomplicated and cost effective kind of life insurance policy.

How do I apply for Indexed Universal Life Financial Security?

While IUL might provide higher prospective returns as a result of its indexed money value development device, it likewise features greater premiums compared to label life insurance policy. Both IUL and entire life insurance policy are sorts of long-term life insurance policy policies that provide survivor benefit defense and money worth growth opportunities (IUL financial security). There are some crucial differences in between these 2 kinds of plans that are crucial to take into consideration when making a decision which one is right for you.

When taking into consideration IUL vs. all various other kinds of life insurance coverage, it's vital to weigh the benefits and drawbacks of each policy kind and talk to an experienced life insurance policy agent or financial adviser to determine the most effective choice for your special requirements and financial objectives. While IUL provides many benefits, it's additionally important to be familiar with the threats and factors to consider related to this type of life insurance policy plan.

Let's dive deeper right into each of these threats. Among the key issues when thinking about an IUL plan is the numerous expenses and charges connected with the policy. These can consist of the cost of insurance coverage, plan costs, surrender fees and any type of extra motorcyclist costs sustained if you include fringe benefits to the plan.

Some might use extra competitive prices on insurance coverage. Inspect the financial investment choices readily available. You want an IUL policy with a series of index fund choices to meet your requirements. See to it the life insurance provider straightens with your individual financial goals, demands, and threat resistance. An IUL policy should fit your certain situation.

What are the top Iul Protection Plan providers in my area?

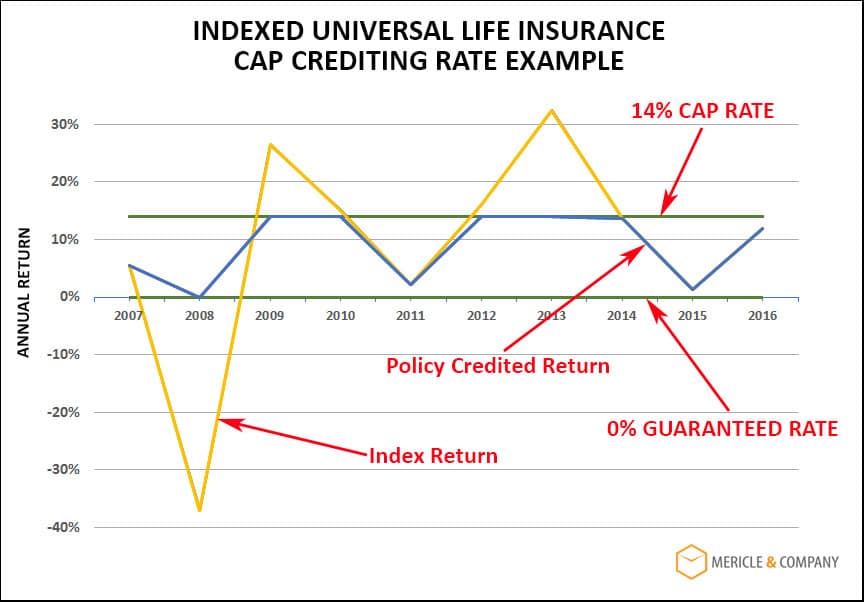

Indexed global life insurance policy can provide a number of advantages for insurance policy holders, consisting of versatile premium settlements and the prospective to earn greater returns. The returns are limited by caps on gains, and there are no assurances on the market efficiency. All in all, IUL policies supply several possible advantages, however it is essential to comprehend their threats.

Life is not worth it for a lot of people. For those looking for predictable long-term financial savings and guaranteed death benefits, entire life might be the far better choice.

How do I apply for Iul For Retirement Income?

The benefits of an Indexed Universal Life (IUL) policy include possible greater returns, no disadvantage risk from market motions, security, versatile repayments, no age requirement, tax-free fatality benefit, and lending accessibility. An IUL plan is irreversible and supplies money worth growth through an equity index account. Universal life insurance policy started in 1979 in the USA of America.

By the end of 1983, all significant American life insurance firms provided universal life insurance policy. In 1997, the life insurance firm, Transamerica, presented indexed global life insurance which offered insurance holders the ability to connect plan development with global stock market returns. Today, global life, or UL as it is also understood comes in a range of different types and is a major component of the life insurance policy market.

The details provided in this short article is for instructional and educational functions only and should not be taken as monetary or investment suggestions. While the author has know-how in the subject, readers are recommended to speak with a certified economic advisor prior to making any type of investment choices or acquiring any kind of life insurance policy products.

What is High Cash Value Indexed Universal Life?

You may not have assumed much about exactly how you want to spend your retired life years, though you most likely know that you do not want to run out of cash and you would certainly like to maintain your current way of life. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings". Guaranteed IUL.] < map wp-tag-video: Text appears alongside the company guy speaking to the camera that reviews "business pension", "social security" and "financial savings"./ wp-end-tag > In the past, individuals relied on 3 primary resources of earnings in their retired life: a business pension, Social Safety and whatever they 'd managed to save

Fewer companies are providing typical pension strategies. Also if benefits haven't been decreased by the time you retire, Social Protection alone was never ever planned to be adequate to pay for the way of living you want and deserve.

Prior to devoting to indexed global life insurance policy, right here are some pros and disadvantages to consider. If you select a great indexed global life insurance plan, you might see your money worth expand in worth. This is helpful due to the fact that you may have the ability to accessibility this cash prior to the strategy ends.

What does a basic Iul For Retirement Income plan include?

Since indexed global life insurance coverage requires a specific degree of danger, insurance policy business tend to maintain 6. This type of plan additionally uses.

Generally, the insurance business has a vested passion in carrying out much better than the index11. These are all variables to be considered when picking the best type of life insurance for you.

However, given that this kind of plan is a lot more complicated and has a financial investment part, it can frequently include greater premiums than various other policies like entire life or term life insurance coverage - Flexible premium IUL. If you don't think indexed global life insurance policy is ideal for you, right here are some options to think about: Term life insurance is a momentary plan that usually offers insurance coverage for 10 to 30 years

Table of Contents

Latest Posts

Equity Index Life Insurance

Iul Retirement

Universal Life Insurance Loans

More

Latest Posts

Equity Index Life Insurance

Iul Retirement

Universal Life Insurance Loans